CVS SKINCARE MARKET ANALYSIS

CUSTOMER RECORDS: ~556,000 | DATES: 1/2020 TO 10/2023

DATA SOURCES: CVS, AMAZON, TARGET, SEPHORA, ULTA, WALMART, WALGREENS

Terms Analysis

Brand Loyalty

Understanding how these terms vary in appeal across age groups can help skincare brands tailor their marketing efforts more effectively to each segment's preferences and behaviors

Bonus

The term "bonus" is most commonly used by the youngest age group (16 to 25) and steadily decreases with age. This suggests that younger consumers value or are more positively responsive to additional perks labeled as a "bonus".

Marketing Implication: Skincare brands targeting younger demographics could benefit from promotions that include a "bonus" item with purchase. For this audience, emphasizing the extra value through a "bonus" could enhance the product's appeal.

Extra

The usage of "extra" increases with age, peaking with the 36 to 45 age group, and then shows a slight decline in the 46 to 55 age group before leveling off for those over 55.

Marketing Implication: Messaging for the 36 to 55 age range might focus on providing "extra" benefits, such as additional skin nourishment or protection features. This group may appreciate products that offer more than the standard benefits, so marketing should highlight any additional product features or ingredients that provide added value.

Gift

The term "gift" is used least by the 16 to 25 age group but increases sharply to peak in the 36 to 45 age bracket. Afterward, its usage slightly declines but remains relatively high for the 46 to 55 and over 55 age groups.

Marketing Implication: The 36+ demographics appear to consider products as potential "gifts" either for others or themselves. Marketing strategies could involve creating gift sets or promoting products as ideal gifts for holidays, birthdays, or other special occasions. For older demographics, highlighting the idea of skincare as a "gift" could resonate well.

MARKETING IMPLICATIONS

Personalization: Personalize marketing campaigns according to age demographics. For example, use "bonus" for younger customers in advertising language, while "extra" and "gift" may be more effective terms for older age groups.

Promotions: Implement age-specific promotions that resonate with the values suggested by these terms. Younger consumers might appreciate a free bonus item, whereas older consumers might respond better to products that offer extra features or are packaged as gifts.

Loyalty Programs: Create loyalty programs that offer "bonuses" for frequent purchases to attract the younger demographic, and "extra" rewards for long-term loyalty which may appeal more to the older demographics.

Gift Services: Provide wrapping services or special packaging for customers who might be purchasing skincare items as gifts, especially targeting the 36 to 55 and over age groups.

Product Performance

The chart below tracks the usage of the phrases "does wonders" and "miracle" in skincare product category across different age groups.

Understanding these preferences can help skincare brands align their marketing strategies with the language that resonates most with their target age demographics, potentially improving engagement and sales within those segments

Does Wonders

The use of the phrase "does wonders" increases with age. It is least mentioned by the youngest age group (16 to 25) and most frequently mentioned by the oldest age group (over 55).

Marketing Implication: Marketing language for skincare products targeting older demographics can resonate more by including testimonials or descriptions that highlight transformative results, using phrases like "does wonders." The positive and potentially more realistic language seems to appeal to this age group.

Miracle

The term "miracle" starts off with higher usage in the youngest age group and steadily declines as age increases, being least mentioned by the over 55 age group.

Marketing Implication: Younger consumers may respond more to marketing that presents a product as exceptionally effective or a quick fix, thus using the term "miracle" in promotional materials may be more compelling for this demographic. However, the decline in usage suggests that as consumers age, they might become more skeptical of such claims or prefer more straightforward language.

MARKETING IMPLICATIONS

Tailored Messaging: Clearly, messaging should be tailored to the age group being targeted. Younger audiences might be more drawn to the allure and promise of immediate or exceptional results ("miracle"), while older audiences might appreciate language that implies steady, reliable benefits ("does wonders").

Expectation Management: For older age groups, marketing should focus on setting realistic expectations, implying that the product is part of a regimen that maintains skin health over time rather than a one-time wonder cure.

Testimonials and Storytelling: Including customer testimonials that resonate with the language preferences of each age group can be effective. For instance, showcasing a user over 55 sharing how a product "does wonders" for their skin could be persuasive for that age group.

Product Positioning: Products may be positioned differently across age groups, with some being marketed as part of a daily skincare routine that yields long-term results for older consumers, and others being positioned as innovative solutions for immediate effects for the younger audience.

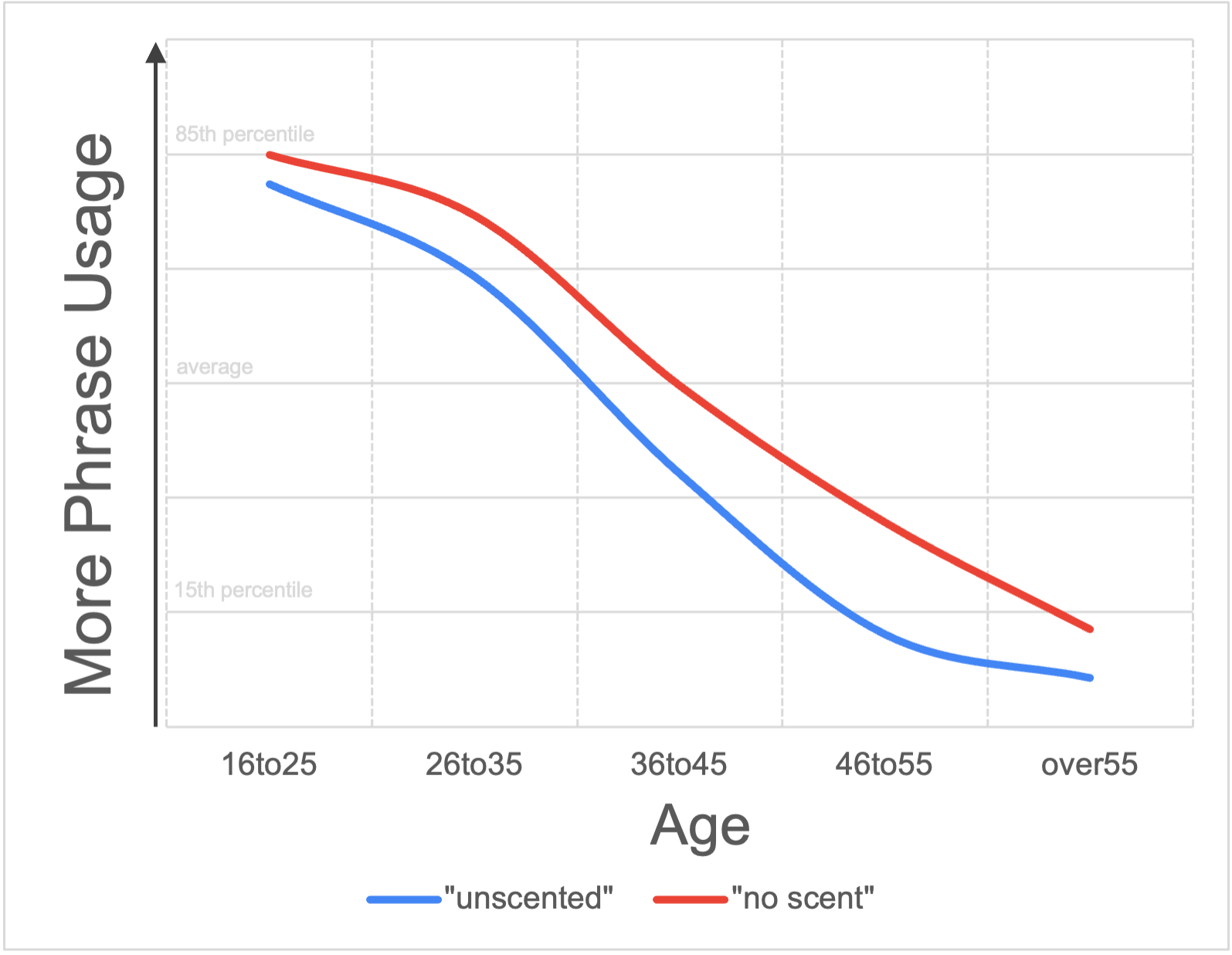

Both phrases in the chart below decline in mention as age increases, with "unscented" starting off more frequently mentioned in the youngest age group and "no scent" being somewhat less mentioned but following a similar downward trend.

The data suggests a stronger inclination towards unscented products among younger consumers. Brands could leverage this insight by tailoring their product development and marketing strategies to meet the preferences indicated by these age-specific trends.

Unscented

The term "unscented" is most prevalent among the youngest age group (16 to 25) and steadily decreases in usage as age increases. This implies that younger consumers are more interested in or are looking for products that are unscented.

Marketing Implication: Skincare brands should consider highlighting "unscented" products in marketing campaigns directed at younger demographics. For new product lines aimed at this age group, the development of fragrance-free options could be prioritized.

No Scent

While also decreasing with age, the term "no scent" is consistently used less frequently across all age groups compared to "unscented." Nevertheless, its trend mirrors that of "unscented," indicating a general preference for products without a strong fragrance among younger consumers.

Marketing Implication: Messaging for products that do not contain added fragrances could use the term "no scent" as a selling point, though "unscented" may be the more impactful term based on its higher mention rate. It’s also essential to note that even though "no scent" is less mentioned, it might not necessarily mean it is less preferred—some consumers might use both terms interchangeably.

MARKETING IMPLICATIONS

Product Formulation: Given the clear interest in fragrance-free products among younger consumers, skincare brands might consider developing and clearly labeling their unscented or no scent product offerings.

Advertising Language: Use age-specific language in marketing materials, with a greater emphasis on "unscented" or "fragrance-free" for younger audiences.

Educational Content: Since both terms decline with age, it could be beneficial to educate older consumers on the benefits of unscented products, particularly for sensitive skin, which might become more of a concern with age.

Market Segmentation: Recognize the potential for a segmented approach to marketing, where different product lines could be promoted to different age groups based on their expressed preferences regarding scents in skincare products.

PRODUCT DESCRIPTION

CONCEPTS BASED ON INSIGHTS

ADVERTISING A/B TEST IDEAS

AD TERMS

GenZ

1. Trending Term for A/B Testing: "lightweight"

A/B test: Showcase products that are marketed as "lightweight"

2. Trending Term for A/B Testing: "oil free"

A/B test: Showcase products that are marketed as "oil free."

3. Trending Term for A/B Testing: "formula"

A/B test: Highlight "formulas" designed to cater to the specific skin needs to signal in-group language to GenZ

AD CONTENT IDEAS

GenZ

A: "Discover the magic of our new Lightweight Serum—perfect for your glow-up!"

B: "Try our new Fresh Gel Moisturizer that keeps your skin hydrated without the weight!"

Millennials

A: "Experience our Essential Non-Greasy Day Cream—your new skincare must-have."

B: "Unlock the benefits of our Sustainable Hydrating Lotion—good for your skin, better for the planet."

GenX

A: "Feel the difference with our Reliable Comfort Cream, designed for mature skin."

B: "Introducing our new Hydrating Anti-Aging Formula—great value skincare that works."

Baby Boomers

A: "Indulge in the luxury of our Timeless Rejuvenating Serum—rich, nourishing, and gentle."

B: "Try our Gentle, Rich Cream for a nourishing experience that rejuvenates your skin."

For each test, CVS can track metrics such as click-through rates, conversion rates, and customer feedback to determine which terms and messaging styles drive the best engagement and sales performance. This data-driven approach will allow CVS to refine their marketing strategies continuously to better meet the needs and preferences of their diverse customer base.

SKIN DESCRIPTIONS

Product Reaction

CONCEPTS BASED ON INSIGHTS

ADVERTISING A/B TEST IDEAS

GenZ

1. Trending Term for A/B Testing: "obsessed"

2. Trending Term for A/B Testing: ""hype"

3. Trending Term for A/B Testing: "crazy"